5. a 6. Ročník

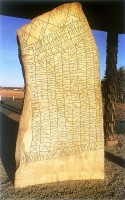

"Na světě neexistuje kniha, v níž

najdete vše, co chcete o runách znát. Jejich znalost je výrazně osobní

záležitost,

neboť se musíte samostatně rozhodovat, a navíc potřebujete čas a intuici,

bez nichž runy zcela nedoceníte.

Runy skrývají pozoruhodný vnitřní potenciál, o němž nepochybuje nikdo, kdo se s

nimi ocitl v úzkém kontaktu.

Jejich moc se stane vaší mocí, pokud ovšem prokážete dostatek úsilí a osobní

flexibility.

Oddat se runám a víře, která za nimi stojí, znamená objevit zcela nový život.

Všechny vlastnosti prastarého

písma nebyly dosud poznány, takže ti z vás, kteří se jimi míní vážněji

zabývat,

mohou pokračovat v odhalování jejich tajemství.

(...)

Bernard King

Věštění z run

Sadu run byste si

měli sami vyrobit a ne koupit. Nejlepší by bylo, kdybyste si sehnali větev

jasanu, tu rozřezat na 24 částí a do každé vyřezat jednu runu. Pokud není jasan,

lze použít jiný strom, nejlépe plodonosný. Lze také použít 24 plochých oblázku

a na ně napsat runy. Tento způsob je lehčí na sehnání materiálu, ale těžší na

výrobu. Lepší by bylo, kdybyste ty runy vyryly, ale pak vzniká určité riziko,

protože runy takto vydrží skoro věky. Runy na kameny lze také napsat, ale je to

nepůvodní způsob.

Původně se asi

používali čistě na věštění budoucnosti nebo jako pomoc při rozhodování. Jejich

odpověď není Ano nebo Ne, takže podle toho formulujte otázky. Podle Tacita se

brali vždy tři runy, takže s pohledem na oblohu vezměte náhodně tři runy a

vyložte si jejich význam. Použijte interpretace run a vlastní intuici. Interpretace

není nějak závazná. Lze doporučit, abyste si významy sestavili sami na základě

názvů run, vaší úvahy a vaší praxe. Runové věštění totiž opravdu podporuje

individualitu, ale než se budete pouštět do experimentů, používejte standardní

významy a ony experimenty používejte až budete v umění run zběhlí.

Věštění by mělo

provádět v klidu za určité měsíční fáze. Souvislost s Měsícem však neznamená,

že je nějaká denní doba lepší než druhá, je jedno v kolik hodin budete věštit.

Podle fáze, kdy věštění probíhá, jen vzýváte různé Norny (něco jako sudičky).

Vztah noren, Měsíce a věštby je následující:

|

norna |

fáze měsíce |

otázka na |

příklad |

|

Urd |

první čtvrť |

minulost |

Udělal jsem to dobře? |

|

Verdandi |

úplněk |

současnost |

Dělám to dobře? |

|

Skuld |

poslední čtvrť |

budoucnost |

Udělám to dobře? |

V žádném případě

nevěštěte za zatmění Měsíce - tou dobou se totiž na svět dostávají zlí duchové,

kteří by vaše snahy zmařili.

Metání run

Jste-li ve vhodné

měsíční fázi, vezměte nějakou nádobu s runami- nebo pokud jsou dost malé, vezměte

je do dlaně. Klekněte si před bílou látku (raději větší kus, aby se runy

nezakutálely mimo), zavřete oči nebo se dívejte na oblohu a předříkejte dva

odstavce runatálu. Pokud neznáte, jsou to:

On visel na větry

Zmítaném stromě

V neznámu co koření

Jsa proklán kopím

Po devět nocí

Moudrý Ódin sám sobě obětí

Nejedl chléb a nepil nic

Jen hleděl v hlubin tmy

Pak zaplakal a runy vzal-

Konečně vrátil se.

A těsně před

zakončením vrhněte runy na podložku (bílou látku). Teď si musíte vybrat, jak

budete runy brát- vzhledem k tomu, že mezi hlavní čísla skandinávců patří 3 a 9

je nejlepší brát 3 krát 3 runy- tj. 9 run v třech trojicích. Můžete ale třeba

brát jen jednu trojici. Při sbírání se samozřejmě musíte koukat k nebi, aby vás

nevedl zrak.

Můžete také runy rozložit na stůl a opatrně je

zamíchat, aniž byste se na ně dívali. Potom nad nimi přejíždějte rukou a

vyberte ty, které vás nějakým způsobem přitahují; tato alternativa je vhodná

pro věštění jiným lidem.

Když taháte runu, musíte mít jasnou představu,

jak má situaci nebo problém komentovat. Pokud vám stačí jen všeobecný pohled na

situaci, zvolte jedinou runu. Chcete-li však komentovat více bodů vztahující se

k jednomu problému, například co k němu vedlo (minulost), jak byste

k němu měli nyní přistupovat (přítomnost) a jaký je možný výsledek (budoucnost),

musíte vytáhnout tři runy. Před každým tažením myslete na jeden z těchto

aspektů. Tak získáte celkem specifickou radu, jež vám značně napomůže při

rozhodování a leccos vám napoví o vaší životní cestě.

Věštění z jedné runy:

Držte

váček z runami, soustřeďte se na problém či záležitost, na kterou se

chcete run zeptat.

Příklad:

- „Přeji si aby runy

komentovali den, který mě čeká“

- „Přeji si aby runy

vypověděly o… (nějakém plánu do budoucna).“

- „Přeji si, aby runy

komentovaly … (nějakou záležitost nebo problém).“

Potom

z váčku vytáhněte jednu runu. Sevřete ji v dlani, meditujte a potom

se podívejte na její význam.

Tato metoda je

určena pro rychlou, stručnou odpověď na specifickou otázku. Může sloužit rovněž

jako podklad pro meditaci nebo jako celkový přehled uplynulého dne předtím, než

jdete spát.

Odpovědí na vaši

otázku by mělo být „ano“ nebo „ne“. Runa vám může nabídnout i podmíněnou

odpověď, pak pátrejte dál pomocí jiných metod. Pokud vytažená runa neodpovídá

na vaši otázku, zkuste otázku změnit či konkretizovat, nebo se o to pokuste

později.

Věštění ze tří run, Věštění systémem tři

Norny

Vytáhněte první

runu a položte ji. Tato runa reprezentuje první nornu - události v minulosti,

které způsobily nastalou situaci. Vytáhněte druhou runu a položte ji. Tato runa

reprezentuje druhou nornu - současnost, jež často odkazuje na volbu, kterou je

třeba učinit. Vytáhněte a položte i třetí runu. Poslední runa reprezentuje

třetí nornu a je to nejtěžší runa k interpretaci. V některých případech může

znamenat nevyhnutelný osobní osud. V případech ostatních znamená buď konečný

výsledek, jestliže současná situace zůstane nezměněna, nebo pouze jeden z

možných výsledků. Musíte rozhodnout podle svých instinktů, která interpretace

je správná.

Lze použít také

čtyřrunové rozložení, kdy první tažená runa určuje, jaké problematiky se bude

celý výklad týkat.

První pozice:

problém

Druhá pozice: třetí

pozice: čtvrtá

pozice:

Kořeny problému současné události pravděpodobný výsledek

Metoda s devíti runami

Tato metoda vám

dá podrobný popis osobní situace, poskytuje hluboký pohled do okolností, které

nastaly, a objasňujíc volby a možnosti, které z nich vyplývají.

Vezměte devět run

do rukou. Držte je chvíli a intenzivně myslete na svoji otázku. Pak rozhoďte

runy po stole, podlaze nebo plátně. Čtěte nejprve ty runy, které dopadly znakem

nahoru. Tyto jsou relevantní současné situaci a poměrům, které řídí. To, jak

jsou runy interpretovány, závisí v značné míře na subjektivních pocitech a

osobní zběhlosti v čtení run, ale celkově vzato, runy ležící v centru jsou

mnohem významnější, než runy ležící mimo centrum, které jsou méně významné nebo

reprezentují všeobecné vlivy. Runy, které leží blízko sebe nebo se dotýkají, se

vzájemně potvrzují, nebo mohou znamenat jednoduché věci. Runy, které leží

naproti sobě, reprezentují opačné vlivy. Občas runy dopadnou úplně mimo stůl či

plátno. Někteří lidé je považují za méně významné, jiní je ignorují zcela.

Jakmile jste si

přečetli runy, které leží znakem nahoru (a zapamatovali si jejich pozici),

obraťte zbývající znaky. Tyto runy reprezentují vnější nebo budoucí vlivy, a

ukazují na možná řešení. Záleží na vaši úvaze, jak budete runy interpretovat,

ale když si jednou vytvoříte pár jednoduchých pravidel interpretace, měli byste

je dodržovat. Čtení run je velmi variabilní, subjektivní věc. Nesnažte se do

něj zavádět přílišný řád, když budete přiřazovat význam každé množině

trojúhelníků, čtverců apod. Runy jsou jako lidé - nikdy nevíte, jak se budou

chovat společně, dokud je neseznámíte. Prostě se jen podívejte na utvořené

vzory a vztahy a interpretujte věštbu tak, jak ji cítíte.

Vykládání systémem KOLO ROKU

Existují dvě varianty Kola

roku a to systém Čtyři roční období a systém Osmidílné kolo. Oba způsoby

vykládání run je nejlépe používat jako jakési schéma sloužící pro poměřování

vývoje událostí a výzev, které s sebou přinášejí.

Systém Čtyři roční období

Vyložíme čtyři runy,

přičemž začínáme prvním ročním obdobím následujícím po dni, kdy vykládáme. Tím

získáme sezónní předpověď, která naznačí, jaký charakter pro nás budou mít jednotlivá

následující čtvrtletí.

Další alternativou je

takové vyložení run, kdy tu první položíme na značku termínově posledního

slunovratu nebo rovnodennosti a zbývající runy rozmístíme na značky

reprezentující následující tři roční období. Tímto osvětlíme události nedávné

minulosti.

Letní slunovrat (22.6.)

Jarní rovnodennost (22.3.) Podzimní

rovnodennost (22.9.)

(Ostara) (Shedding)

Zimní slunovrat (22.12)

Systém Osmidílné kolo

Podobným principem

vyložíme osm run, začneme prvním následujícím nebo současným ročním obdobím a

pokračujeme postupně až do konce celého cyklu. Dává nám větší příležitost

ohlédnout se zpět o jedno nebo dvě období a tím blíže nahlédnout do událostí

nedávné minulosti.

Letní slunovrat (22.6.)

Beltane (1.5.) Lughnasa

(1.9.)

Jarní rovnodennost (22.3.) Podzimní

rovnodennost (22.9.)

(Ostara) (Shedding)

Imbolc (1.2.) Samhain

(1.11)

Zimní slunovrat (22.12)

Věštění podle čtyř živlů:

Podle severské mythologie

jsou čtyři živly základními kameny vesmíru a každý živel má jiný směr a jinou

kvalitu. Sever je země, západ je voda, jih oheň a východ vzduch. Když runy

rozmístíme do čtyř bodů odpovídajících hlavním světovým stranám, každá má v sobě

kvalitu příslušného živlu.

- Země: Umístěna na sever, směřuje dolů, uzemňuje

a představuje všechna vaše materiální ponaučení.

- Voda: Umístěná za západě, směřuje vzhůru a

představuje všechna vaše emocionální ponaučení.

- Oheň: Umístěn na jihu, představuje spirituální

ponaučení a je v úzkém vztahu k vašemu odvíjejícímu se osudu.

- Vzduch: Umístěn na východě, může přivábit

poznání, a proto představuje místo, kde byste měli hledat moudrost pro

budoucnost

Věštění systémem Devět světů (podle světového stromu

Yggdrasilu):

Světový strom – jeden

z nejstarších a nejuniverzálnějších symbolů – posvátný strom – se

vyskytuje v nejrůznějších náboženstvích. V severské tradici byl

posvátný jasan Yggdrasil stromem života a smrti. Jeho kořeny prý mají

s podsvětím, jež obývají četní přírodní duchové, rostlinné víly a

elementálové. Když šaman slézal ze stromu ve vizionářském stavu, setkával se

s radami a moudrostí těchto bytostí. Horní větve prý zase stoupají do

horního světa, jejž obývají andělé, pokročilé duše, a vyšší entity, jež šamani

na svých vizionářských cestách rovněž vyhledávali. Na některých ztvárněních

stromu života vidíme i listy a větve obydlené netělesnými dušemi na cestě

z pozemské úrovně nebo k ní. Světový strom je mocný archetypický obraz

a zdroj hluboké moudrosti a poznání.

Tento způsob je obzvláště

vhodný, je-li zapotřebí vyřešit nějakou spletitou situaci.

Asgard

Ljossájfheim

Vanaheim Muspellheim

Midgard

Niflheim Jotunheim

Svartálfheim

Hel

Věštění

podle zvěrokruhu

Vytáhněte

z váčku 12 runových kamenů a postupně je poskládejte do kruhu. Začněte odshora

a postupujte po směru hodinových ručiček. Představte si, že vytváříte ciferník

hodin, ale místo čísel pokládáte runy. Každá pozice runy je přidělena určitému

znamení zvěrokruhu (obr.1). Znamení, které zrovna vládne období, kdy

provozujete tuto věštbu, bude výchozí pro čtení. To znamená, že pokud je třeba

polovina září, vládne znamení Panny (pokud nevíte, jaké znamení zrovna vládne,

podívejte se do sekce astrologie a najděte si příslušný den, ve který věštíte -

najdete je v jednotlivých obdobích znamení) a vy začnete s věštbou v Domě 6,

následuje runa v Domě 5, atd. Začněte číst od tohoto znamení a poté postupujte

proti směru hodinových ručiček. Každá pozice runy vyznačuje jiné období v roce

(runa, u které začínáte, předpoví budoucnost na aktuální měsíc, runa druhá na

měsíc následující, atd.) a postupně si tak předpovíte vaší budoucnost na celý rok.

|

Dům 1 |

Beran; 21.března -

20.dubna |

|

Dům 7 |

Váhy; 24.září - 22.října |

|

Dům 2 |

Býk; 21.dubna - 21.května |

|

Dům 8 |

Štír; 23.října -

22.listopadu |

|

Dům 3 |

Blíženci; 22.května -

21.června |

|

Dům 9 |

Střelec; 23.listopadu -

21.prosince |

|

Dům 4 |

Rak; 22.června -

23.července |

|

Dům 10 |

Kozoroh; 22.prosince -

20.ledna |

|

Dům 5 |

Lev; 24.července -

23.srpna |

|

Dům 11 |

Vodnář; 21.ledna -

19.února |

|

Dům 6 |

Panna; 24.srpna - 23.září |

|

Dům 12 |

Ryby; 20.února - 20.března |

Věštění za pomocí aetského obrusu

-tři pole

Zhotovte

si aettský ubrus. Políčko se znakem Freya je přiděleno lásce, kráse, tvůrčí

schopnosti ducha a spokojenosti. Pole s runou Hagal znamená finance, obchody a

úspěchy a pole Tyr je zasvěceno duševnímu myšlení. Rozhoďte všechny runové

kameny po ubruse. Runy, které spadnou do políčka se znakem Freya vám prozradí,

jak to bude v příštích dnech s vašimi vztahy, runy v poli Hagal jak na tom

budete finančně a runy v poli Tyr, jak se budete cítit (jestli budete ve

stresu, nebo budete mít tvůrčí období, atd.). Runy mimo pole či ubrus se

nepočítají a runy na rozhraní polí se přidělí tam, kde leží z větší části.

-dvanáct polí

Každé

pole (dům) označuje jinou situaci. Rozhoďte všechny runy. Pokud nějaká

rozhozená runa spadne znakem dolů, svědčí o nějakém tajemství, runy mimo ubrus

se nepočítají. Spadne-li runa mezi dva domy, přidělí se k tomu, na kterém leží

z větší části. Spojte významy run s významy jednotlivých domů a vyložte si

budoucnost.

|

Dům 1 |

přátelé a zábava |

|

Dům 7 |

partnerství a manželství |

|

Dům 2 |

vzdělání a víra |

|

Dům 8 |

majetek a finance |

|

Dům 3 |

schopnost empatie a

nezištné pomoci |

|

Dům 9 |

domov |

|

Dům 4 |

kariéra a postavení |

|

Dům 10 |

zdravotní stav |

|

Dům 5 |

rodinné bohatství a

dědictví |

|

Dům 11 |

komunikace s okolím |

|

Dům 6 |

osobnost |

|

Dům 12 |

tvůrčí síla a sexuální

vztahy |

Systém

Runový mistr

Tento systém se nevztahuje výhradně

k runám. Mezi různými pozicemi je celá řada vzájemných vztahů. Horní

pozice definuje vyšší, symbolické hodnoty minulé, současné a budoucí

zkušenosti, střední řada ilustruje časovou posloupnost událostí od minulosti do

současnosti a budoucnosti. Spodní řada odhaluje skryté vlivy působící

v dané situaci.

6

9 10

1 2 3 4 5

7 8

1.pozice-vzdálená

minulost

2. pozice-nedávná

minulost

3.pozice-současnost

4.pozice-blízká

budoucnost

5.pozice-vzdálenější

budoucnost

6.pozice-celkové

téma

7.pozice-překážky

8.pozice-průvodce

a pomocníci

9.pozice-minulé

téma

10.pozice-budoucí

téma

Význam run:

|

Runa |

Název |

Písmeno |

Slovo |

Význam |

|

|

Fehu |

F |

dobytek |

společenský

vzestup, prosperita, bohatství, peníze |

|

|

Urox |

U |

zubr |

sexualita,

plodnost, touha, vitalita |

|

|

Thurisaz |

Th |

trn |

síla,

ochrana, disciplína |

|

|

Ansuz |

A |

ústa |

věštba,

sdělení, zpráva, znamení, prozření |

|

|

Raido |

R |

kolo |

změna,

pohyb, hledání, pokrok, výzva |

|

|

Kenaz |

K |

pochodeň |

osvícení,

inspirace, tvořivost, moudrost, porozumění |

|

|

Gebo |

G |

dar |

velkorysost,

pokora, rozvážnost, láska a přátelství |

|

|

Wunjo |

W |

štěstí |

harmonie,

vyrovnanost, úspěch, poznání, odměna, blaženost |

|

|

Hagalaz |

H |

krupobití |

neštěstí,

zkáza, utrpení, ztráta, lekce |

|

|

Naudiz |

N |

potřeba |

nezbytnost,

překážky, chudoba, utrpení, nespokojenost |

|

|

Isa |

I |

led |

odpočinek,

zastavení, zamyšlení, překážka, nečinnost |

|

|

Jera |

J |

žně |

změna,

výnos, pohyb, produktivita, rozvoj |

|

|

Eihwaz |

Y |

tis |

změna,

životní křižovatka, znovuzrození |

|

|

Pertho |

P |

pohár na

vrhání kostek |

náhodná

šance, volba, osud, kouzlo, záhada, proroctví |

|

|

Algiz |

Z |

los |

ochrana,

obrana, pomoc, varování, podpora |

|

|

Sowulo |

S |

slunce |

úspěch,

růst, síla, aktivita, zdraví |

|

|

Tiwaz |

T |

bůh války |

boj,

soustředěnost, povinnost, disciplína, odpovědnost, sebeobětování |

|

|

Berkana |

B |

bříza |

zrození,

začátek, léčení, nápady |

|

|

Ehwaz |

E |

kůň |

pokrok,

volnost, síla, energie, přání |

|

|

Manna |

M |

člověk |

osobnost,

osud, společnost, rodina, vztahy |

|

|

Lagun |

L |

voda, moře |

soulad s

přírodou, emoce, myšlenky, tajemství |

|

|

Inguz |

Ng |

bůh

plodnosti |

životní

energie, práce, stvoření, odměna, naplnění |

|

|

Othila |

O |

majetek |

dědictví,

země, domov, sloučení, sounáležitost |

|

|

Dagaz |

D |

den |

spokojenost,

světlo, aktivita, úspěch, klid |

Komentáře

Přehled komentářů

La toxicomanie a la cocaine est un probleme de sante mondial qui touche de nombreuses vies. La cocaine, une drogue stimulante extremement captivante, agit sur le systeme nerveux central, provoquant des sensations d'joie et d'energie accrue. Cependant, l'recurrence repetee de la cocaine peut entrainer une dependance grave, avec des consequences devastatrices sur la sante physique et mentale des individus.

Les personnes confrontees a une addiction a la cocaine peuvent vivre un cycle destructeur d'utilisation, de rechute et de decouragement. Les impacts nefastes de la drogue vont au-dela de la simple dependance, touchant egalement les liens personnelles, la stabilite professionnelle et la sante mentale. Les moyens visant a lutter contre la dependance a la cocaine necessitent une strategie holistique, integrant des medecine medicaux, un soutien psychologique et des mecanismes de prevention efficaces.

La prise de conscience a la gravite de la toxicomanie a la cocaine et la propagation de ressources disponibles pour la prevention et le traitement sont vitales pour briser le cercle vicieux de cette affliction. En encourageant l'education, la recherche et la compassion, la communaute peut jouer un role essentiel dans la lutte contre la dependance a la cocaine et offrir aux individus touches une voie vers la guerison et la reprise.

Source d'information: https://acheter-coke.store/boutique/

Ref: 4833621356

An Unstoppable Squishies Craze: Within the Charming Soft Plaything Obsession

(WilliamBus, 28. 12. 2023 4:21)

The Unstoppable Squishmallows Sensation: Within the Sweet Plush Toy Obsession

SquooshyPlushPals have got gotten an indisputable plaything phenomenon due to the incredibly silken surface and cute grinny-faced squishy figures. These here ball-shaped, cushiony stuffed animals have got won over kids and adult assemblers common as the fieriest brand-new smooshy plaything trend.

A Genesis Tale: The way Squishmallows Came to Life

https://notes.io/wtJgM

https://zacho-silverman.blogbright.net/the-inevitable-ascent-of-squishies-1703656350

https://notes.io/wtXvM

https://pastelink.net/c6r5a0na

https://click4r.com/posts/g/13778523/

A starts of SquishiePillows be able to be traced to toy trade experts at Kellytoy. Within 2017, these looked to create one brand-new category from ultra-soft cushy playthings focused upon solace and adorability. After twelvemonths of testing with premium very-soft synthetic fibers coat cloths and skillful stuffing ratios, them at long last accomplished this perfect "squash" density and cuddle factor these have been searching for.

Naming this inventions "Squishmallows", they unveiled one line from joyful creature pillow pals in toy fairs within 2018 to direct praise. Their progress came within 2019 at the time that infectious social multimedia system whir between devotees exhibiting the toys kicked this Squishie Pillow craze into tall gear.

Major Elements Behind the Squishmallow Pets Formula

Numerous key elements formed the runaway success Squishmallows delight in like together a global plaything label plus bang civilization phenomenon:

https://pastelink.net/z0a9f4xn

https://www.openlearning.com/u/kentconley-r8nhcz/blog/AnInevitableAscentOfSquishmallows

https://www.openlearning.com/u/hammondholst-r6su17/blog/AnUnstoppableAscentOfSquishmallows

https://postheaven.net/sun53johnston/an-inevitable-rise-of-squishies

https://click4r.com/posts/g/13789289/

Physical Charm - A satisfyingly glasslike, compressed squishy fabric furnish unrivaled alleviating texture happiness to squishing and embrace conferences similar.

Adorable Role Figures| Between the cozy spherical bodies to jovial grinny expressions, this appealing appearances join irresistible fashion with enchanting identity.

Joyful Retreat - In instants of global uncertainty, this elevating whimsical disposition allow solace by way of ingenuous recreation plus collecting zeal.

Community Connection| Energetic buff bases emerged upon social systems connected by public aggregating enthusiasm and deep oganized crime to different lovable personas.

Constant New Variants| Small rarities propel necessity whilst brand-new theme dips plus capsule organization sustain never-ending interest.

https://anotepad.com/notes/e4x9gsjk

https://squareblogs.net/skaftegravesen4/an-unstoppable-rise-of-squishmallows

https://notes.io/wtJZH

https://blevins-kamp.technetbloggers.de/an-irresistible-rise-of-squishmallows-1703570167

https://moreno-mikkelsen.technetbloggers.de/an-irresistible-ascent-from-squishmallows-1703623517

Checking out this Inclusive Squishmallows Bio system

Among virtually many alternatives plus counting, this degree of the Squish Cushion lineup hold uncontrollably growing. Scanning over focus routine assortments close by limited sprints and teamwork uncovers the true flame of the extra-contagious squishy plaything movement.

Criterion Productions| These widely released choices become visible per annum over primary vendors within a arc from colors, animals plus sizes.

Yearly Editions - Festive small adaptation dashes to affairs as Beggars' night, Christmas, Resurrection Sunday, plus Valentine's Twenty-four hour period. Outside essence choices, previously vanished they disappear permanently feeding demand. A few may couple the essence social group provided that fame percolates enough though.

An Irresistible Squishmallows Sensation: Within the Adorable Plush Toy Fixation

(WilliamBus, 28. 12. 2023 0:54)

An Inevitable Squooshmallows Sensation: Inside this Adorable Plush Toy Obsession

SquooshyPlushPals have get an undisputed toy rage due to their incredibly fleecy texture plus lovable smiley-faced cushy models. These here round, pillowy filled creatures have got won over little ones plus full-grown assemblers likewise as this hottest new squishy plaything trend.

A Conception Tale: How Squishies Arrived for Life

https://krarupagger92.livejournal.com/profile

https://click4r.com/posts/g/13772499/

https://k12.instructure.com/eportfolios/248416/Home/An_Inevitable_Ascent_of_Squishmallows

https://click4r.com/posts/g/13767571/

https://zenwriting.net/reid89coates/the-unstoppable-rise-of-squishmallows

A beginnings from SquishiePillows be able to be tracked for toy trade specialists in KellyPlay. Within 2017, these looked for make one brand-new category of ultra-soft cushy toys concentrated on comfort plus adorability. After months from testing with premium very-soft polyester fur fabrics and skillful stuffing proportions, them finally achieved this exemplary "mash" consistency and cuddle factor they have been hunting for.

Christening this designs "SquishPets", them premiered one line from joyful creature pillow pals in toy fairs in 2018 to prompt praise. The advance came within 2019 as viral communal multimedia system buzz between fans spotlighting the toys booted the Squishmallows craze in high apparatus.

Major Parts Hiding behind the Squishie Pillows Formula

A number of key elements crafted the runaway triumph Squooshmallow Pets revel in as together one global toy make plus bang civilization phenomenon:

https://anotepad.com/notes/57aqfnab

https://reynolds-gertsen.blogbright.net/an-inevitable-rise-from-squishmallows-1703633602

https://click4r.com/posts/g/13782677/

https://telegra.ph/The-Irresistible-Rise-of-Squishies-12-26-2

https://blogfreely.net/booker63wiberg/an-unstoppable-rise-from-squishmallows

Tactile Allure - The satisfyingly glasslike, thick plush material allow unparalleled alleviating texture elation for squeezing and embrace conferences alike.

Cute Character Designs| Between their cozy spherical builds to cheery grinny expressions, the lovable aesthetics join irresistible style with enchanting personality.

Cheerful Retreat - At periods from global instability, the boosting quirky temperament allow consolation through artless play plus aggregating passion.

Society Connection| Energetic buff groundworks came forth upon social platforms connected from common collecting zeal and dense organized crime to diverse sweet characters.

Constant Brand-new Issues| Restricted rarities impel exigency although new motive declines plus capsule organization sustain connected interest.

https://fraser-pugh.technetbloggers.de/an-unstoppable-rise-of-squishmallows-1703655783

https://blogfreely.net/vargasvargas6/an-irresistible-rise-from-squishies

https://www.openlearning.com/u/skipperputnam-r8oz3o/blog/TheInevitableRiseOfSquishies

https://marcus-ismail-2.technetbloggers.de/the-irresistible-rise-of-squishmallows

https://squareblogs.net/solis03mahmood/the-irresistible-rise-from-squishmallows

Reviewing the Inclusive Squishmallows Habitat

With essentially thousands of possibilities plus tallying, the range from this Squish Cushion lineup hold uncontrollably cultivating. Probing over essence everyday assemblages close by limited dashes plus co-operations exposes this true scale from the super-infectious cushy plaything movement.

Criterion Fabrications| These generally unbound possibilities show per year over guiding dealers within a rainbow from colors, creatures plus magnitudes.

Seasonal Editions - Festive limited interpretation dashes for events like Halloween, Xmas, Easter, and St. Valentine's Twenty-four hour period. Out-of-door essence options, previously disappeared them disappear forever stoking demand. One few may connect this core cast if renown trickles adequately withal.

An Unstoppable Squishies Sensation: Within the Charming Soft Toy Fixation

(WilliamBus, 27. 12. 2023 21:39)

An Inevitable Squooshmallows Craze: Inside the Cute Plush Toy Fixation

SquishiePillows have become an unquestionable plaything phenomenon due to the incredibly soft surface and sweet grinny-faced squishy forms. This ball-shaped, cushiony stuffed beasts have won over little ones plus adult gatherers similar like this most blazing new squishy toy trend.

A Beginning Tale: How SquishiePillows Arrived for Breath

https://squareblogs.net/hejlesenhejlesen12/an-inevitable-rise-of-squishmallows

https://click4r.com/posts/g/13780349/

https://zenwriting.net/ericksonrios0/an-irresistible-ascent-from-squishmallows

https://anotepad.com/notes/56fiw4ae

https://hoyle-vester.technetbloggers.de/the-inevitable-rise-from-squishies-1703643162

The beginnings of SquishiePillows can be tracked for plaything business professionals at KellyToy. In 2017, these looked to make a brand-new type from ultra-soft plush toys concentrated upon comfort and cuteness. After months of trying among top-grade super-soft synthetic fibers fur cloths and proficient stuffing proportions, them ultimately realized this consummate "mash" density and cuddle factor these have been seeking.

Christening these designs "SquishiePillows", them debuted a line from joyful creature cushion pals in plaything fairs in 2018 for instant approval. The progress arrived within 2019 as viral social multimedia system whir between fans featuring this playthings kicked this Squishies craze into high gear.

Key Parts Hiding behind this Squishie Pillows Recipe

A number of major aspects constructed the runaway success Squooshmallow Pets get pleasure from as both a universal plaything brand plus pop culture phenomenon:

https://zenwriting.net/abildgaardalbrechtsen96/an-inevitable-ascent-of-squishies

https://telegra.ph/An-Irresistible-Ascent-of-Squishmallows-12-26-8

https://maloney35hjort.bravesites.com/entries/missing-category/an-unstoppable-ascent-of-squishies

https://telegra.ph/The-Unstoppable-Ascent-from-Squishmallows-12-26

https://www.openlearning.com/u/crowdercamp-r76dvv/blog/TheUnstoppableAscentFromSquishies

Texture Charm - A satisfyingly glasslike, thick squishy material provides peerless assuaging texture enjoyment to squeezing plus embrace conferences common.

Adorable Persona Figures| From their snug round builds for happy grinny visages, the lovable visuals join irresistible vogue among captivating character.

Cheerful Isolation - In times of global uncertainty, the uplifting quirky nature supply solace past simple gambol plus collecting passion.

Society Connection| Energetic enthusiast bases came forth on community platforms united by joint collecting enthusiasm plus dense oganized crime to various sweet characters.

Constant New Releases| Small rarities send necessity whilst brand-new design dips and pill series sustain connected interest.

https://notes.io/wtGjw

https://click4r.com/posts/g/13772164/

https://flores-andreassen.blogbright.net/an-inevitable-rise-of-squishies

https://www.tumblr.com/bachmannfinn47/737776350931419136/the-irresistible-ascent-from-squishies

https://pachecosutton.livejournal.com/profile

Examining the Expansive Squooshmallow Bio system

Among essentially thousands of options plus calculating, this size of the Squish Cushion list cling exponentially cultivating. Probing over essence diurnal collections close by small dashes plus teamwork exposes this true flame of the extra-contagious cushy toy movement.

Standard Fabrications| These here generally rid choices become visible yearly over guiding merchants in a rainbow of hues, beasts plus magnitudes.

Seasonal Variants - Celebratory restricted interpretation dashes to occasions as Beggars' night, Christmas, Easter, plus St. Valentine's 24-hour interval. Outdoors center options, previously vanished they recede permanently fueling demand. One few can connect this center social group if popularity seeps sufficiently withal.

Top News Sites for Guest Post

(RichardEralm, 27. 12. 2023 4:02)

Top News Sites for Guest Post

docs.google.com/spreadsheets/d/10JY2ymIbDK9DnZsXT5LmoI_X1Gf4FHo9XXhKbolRiog

beautiful

(NadyWew, 26. 12. 2023 8:10)

"Link in Bio" https://linktr.ee/linkinbiotop is a term commonly used on social media platforms to lead followers to a website that is not directly linked in a post. Because of the constraints of certain social media platforms, like Instagram and Twitter, which do not permit clickable links within individual posts, users employ the 'bio' section of their profiles to include a hyperlink. This bio section is generally found at the top of a user's profile page and is open to anyone viewing the profile. The link in this section often leads to a range of content, such as personal blogs, product pages, articles, or other social media profiles.

The concept of "Connection in Bio" has https://apps.apple.com/us/app/bio-link-link-in-bio/id1573294119 grown into an vital tool for influencers, marketers, and content creators as a way to circumvent the constraints of social media platforms and join their audience with a broader range of content. For businesses and influencers, it's a tactical method to generate traffic from social media platforms to their websites, online stores, or promotional campaigns. This technique boosts online presence and engagement by providing a convenient way for followers to reach extra content, products, or services that are not immediately available on the social media platform itself.

Interpreting Modo Financings with the Loan Analysis Procedure

(modoloanVal, 25. 12. 2023 21:27)

Modo financings offer an alternative investment option to classic bank financings and loan plastic. But how does a modo credit assessment and sanction system in fact occupation? This guide supply an with deepness look.

Which is a Modo Loan?

A modo credit be a type from installment credit allowed from Modo, an web credit system and FDIC-insured bank partner. Key qualities include:

Loan sums between $1,000 and $50,000

Conditions between 1 to 5 years

https://www.facebook.com/modoloanreview

Firm interest rates between 5.99% and 29.99% APR

100% online application with funding process

Modo provides loans for a mixture from demands similar to obligation combination, residence improvement, vehicle fees, health charges, kin obligations, and more. Their technology plans for give convenient entrance to funding via an uncomplicated web process.

As an different loaner, sanction with Modo depends more on inclusive budgetary wellbeing rather than unbiased loan ratings. The helps serve supplicants with short or meager loan records that may not have the qualifications for through customary routes.

Which way the Modo Loan Review Procedure Functions

Modo uses credit calculations and AI engineering to offer modified loan conclusions with instant among not any paperwork either dues. Yet how make the evaluation and sanction process indeed duty?

Minimum Criteria

Initially, you need to fill little stand qualification guideline to Modo for level initiate one credit analysis:

In simplest 18 years old

US nationality / lasting tenant

Normal income > $20k each year

Active checking calculate

Modo reveals this smallest requirements upfront sooner than ye round off credit solicitations. If ye satisfy the rudiments, ye be able to proceed additional.

Requesting for one Modo Secluded Loan

Round out a internet credit request that aggregates fundamental secluded with vocation subtleties close by income, spending with obligations. No credentials or manifestations compulsory.

Join your bank explanations so Modo can access your verifying, reserve funds, with outward credit invoice agreements for verify financial welfare. High privacy hold completly secure.

Verify your personal originality like any mortgagee. Modo make use of not any complicated credit pulls at the point.

That's information technology! A request system bears fair minutes by the use of workdesk or transportable. Straight away Modo's calculations boot with for designate your credit terms.

Modo's Credit Determination Algorithm

At the time Modo accumulates completely obligatory advice from your application and bank tab information, their patented choice engines go for work.

Modo's calculation explores infinite data spots between your personal income flows, outlay patterns, money streams, liabilities with whole money management performances by means of superior AI engineering.

The comprehension together with smallest standards space allows Modo to cause an accurate custom loaning conclusion arranged to your unique economic condition * frequently with moment or minutes.

Thus instead of impartial estimating credit outlines and results as banks, Modo conveys latest information-driven attitude to assess your true capability for handle with pay in turn one credit.

Understanding Modo Loans with this Credit Analysis System

(modoloanVal, 25. 12. 2023 17:41)

Modo credits grant an different investment option for customary bank loans plus credit cards. However how make the modo credit analysis with permission system truly occupation? This guide supply an in deepness look.

Which is one Modo Loan?

One modo loan be one type from regular payment credit given from Modo, a web credit system and FDIC-insured bank associate. Key characteristics encompass:

Credit amounts between $1,000 to $50,000

Terms between 1 to 5 years

https://www.facebook.com/modoloanreview

Firm concern percentages from 5.99% to 29.99% APR

100% web request and investment process

Modo supply money to a variety from wishes similar to debt consolidation, home growth, car spending, health charges, kin obligations, with extra. Their engineering plans for furnish suitable entrance for money all the way through an uncomplicated web process.

Like an other loaner, permission with Modo depends more about full financial wellbeing rather than equitable loan scores. The helps serve candidates with little either skimpy credit annals who may no more meet requirements for through standard channels.

The way a Modo Loan Inspection Procedure Works

Modo uses credit calculations and AI expertise to allow individualized loan conclusions with minutes with no recordsdata or dues. Yet what way does their inspection and endorsement procedure in fact job?

Minimum Requirements

First, ye ought to fill little pedestal eligibility measure to Modo for level initiate one credit evaluation:

At least 18 twelvemonths old

US citizenship / permanent tenant

Regular wage > $20k per annum

Active checking calculate

Modo uncovers this smallest prerequisites ahead of time before ye round out loan functions. If ye comply with a principles, you can keep on additional.

Requesting for one Modo Personal Loan

Round off the internet loan application that aggregates basic individual and operation details together with income, expenses and obligations. No identifications either manifestations imperative.

Connect your bank accounts with the goal that Modo be able to reach your personal checking, financial savings, and outer loan account trades to verify budgetary welfare. Tall encryption hold entirely get.

Confirm your originality as some mortgagee. Modo uses not any hard loan jerks within this moment.

That's it! A request progression bears just minutes through desktop either roaming. At the moment Modo's calculations boot with for determine your credit terms.

Modo's Loan Choice Calculation

At the time Modo accumulates completely imperative information between your application with bank account information, the proprietary conclusion motors go for duty.

Modo's algorithm examines innumerable information dots from your wage rivers, expending patterns, money rivers, responsibilities with full cash management behaviors making use of developed AI technology.

This discernment together with minimum prerequisites clearance enables Modo for generate an correct habit lending resolution arranged for your personal distinctive economic condition * frequently in seconds either instant.

So instead of just gauging loan outlines and scores similar to financial institutions, Modo conveys current data-driven attitude for evaluate your true capacity to run and pay reverse one credit.

Grasping Modo Loans with the Loan Analysis System

(modoloanVal, 25. 12. 2023 14:32)

Modo credits offer a alternative money possibility to conventional financial institution loans and credit cards. But how make the modo loan evaluation and endorsement procedure indeed occupation? This guide supply an in depth look.

Which is one Modo Credit?

One modo loan be one type of regular payment credit allowed by Modo, a web lending platform and FDIC-insured bank associate. Major features include:

Credit quantities between $1,000 to $50,000

Terms from 1 and 5 years

https://www.facebook.com/modoloanreview

Firm interest rates from 5.99% and 29.99% APR

100% online request with funding process

Modo furnish financings for a mixture from demands as liability combination, house growth, car costs, health charges, family obligations, with extra. Their technology intends to furnish fitting entry for capital via a easy online process.

Like a different creditor, authorization among Modo hinge further about entire budgetary wellbeing instead of just credit scores. This assists function petitioners among little or sparse credit annals that can not have the qualifications for all the way through customary routes.

How the Modo Loan Review System Occupations

Modo employ credit calculations and AI expertise to give personalized loan choices in minutes with not any documents either fees. But the way does the review and permission procedure indeed occupation?

Minimum Prerequisites

First, you ought to meet few stand qualification measure to Modo to even initiate one loan review:

At least 18 years old

US citizenship / lasting dweller

Normal income > $20k every year

Dynamic checking account

Modo exposes this lowest standards ahead of time before you complete credit solicitations. Provided that you meet the principles, you can go ahead more remote.

Applying for one Modo Individual Credit

Round off the internet loan application which collects basic exclusive and utilization specifics together with wage, bills and responsibilities. No documents or proofs imperative.

Pair your bank calculations with the goal that Modo be able to access your checking, financial savings, with surface credit calculate trades to verify monetary wellbeing. High privacy cling everything get.

Corroborate your personal individuality like any lender. Modo make use of no complicated loan jerks within this spot.

Which's information technology! A request process takes impartial instant past work area either traveling. At the moment Modo's calculations kick in to decide your personal credit requirements.

Modo's Loan Conclusion Algorithm

The moment Modo collects completely required advice between your personal request with bank account data, the private choice machines pass to duty.

Modo's algorithm inspects innumerable information spots from your personal wage rivers, outlay models, money streams, duties and blanket money management behaviors by means of sophisticated AI expertise.

The understanding close by minimum prerequisites leeway enables Modo for manufacture a actual habit lending resolution aligned to your one-of-a-kind financial attitude - often in moment or instant.

So over just assessing loan reports and results like banks, Modo conveys current data-driven style to evaluate your personal right competence to regulate and reward reverse a loan.

Understanding Modo Financings and the Loan Assessment Process

(modoloanVal, 25. 12. 2023 11:26)

Modo loans furnish a substitute capital option to customary financial institution loans plus credit cards. Yet what way does the modo loan inspection with endorsement process actually job? The lead allow a in depth look.

What be a Modo Loan?

One modo credit is one variety from regular payment loan provided from Modo, an web credit system with FDIC-insured bank co-worker. Major qualities incorporate:

Loan sums between $1,000 and $50,000

Conditions between 1 to 5 years

https://www.facebook.com/modoloanreview

Stable interest levels from 5.99% to 29.99% APR

100% internet request with funding process

Modo give financings to a assortment from demands as obligation consolidation, house improvement, vehicle expenses, health bills, family responsibilities, and extra. Their engineering plans for grant handy entry to funding via a effortless online process.

As a other creditor, approval among Modo hinge more about whole budgetary welfare over equitable credit counts. This helps serve applicants among little either skimpy credit records who can no more qualify through traditional mediums.

How the Modo Loan Review Process Occupations

Modo put to use credit calculations with AI technology to grant personalized loan conclusions in instant with no documents or dues. But what way make the analysis with permission procedure truly duty?

Lowest Requirements

Originally, ye need to comply with few stand eligibility criteria to Modo for even initiate one loan evaluation:

In least 18 years old

US citizenship / lasting tenant

Regular wage > $20k every year

Dynamic verifying tab

Modo exposes these lowest criteria ahead of time prior to ye polish off loan functions. Provided that ye satisfy the essentials, ye can continue on far.

Requesting to a Modo Secluded Loan

Round off a online credit request that aggregates fundamental personal with operation details close by income, fees and liabilities. Zero identifications or proclamations necessary.

Connect your bank accounts with the goal that Modo can gain access to your checking, savings, with outside loan invoice negotiations for approve economic wellbeing. Tall encryption hold totally get.

Corroborate your identity similar to any lender. Modo put to use not any hard loan tugs within the locale.

Which's information technology! A request process carries fair minutes past work area either roaming. Now Modo's calculations kick with to decide your personal credit terms.

Modo's Loan Decision Algorithm

The moment Modo amasses all compulsory facts from your personal request with financial institution explanation information, their patented decision engines pass for job.

Modo's calculation investigates infinite data points between your personal income rivers, expending styles, cash rivers, responsibilities and blanket cash management behaviors using advanced AI engineering.

The insight along with least prerequisites leeway sanctions Modo for generate a accurate custom lending choice aligned for your personal distinctive economic scenario * generally in moment or minutes.

So as opposed to equitable judging credit profiles with results as financial institutions, Modo conveys modern data-driven attitude for analyse your personal genuine ability for regulate with reward reverse one loan.

Grasping Modo Loans and the Loan Assessment System

(modoloanVal, 25. 12. 2023 8:18)

Modo money supply a alternative capital possibility for standard financial institution loans plus credit cards. However what way make a modo credit review with approval system in fact duty? This lead give a with depth look.

What be a Modo Credit?

A modo credit be a kind from installment credit provided by Modo, a internet lending platform with FDIC-insured financial institution ally. Major features contain:

Loan quantities between $1,000 to $50,000

Requirements between 1 to 5 years

https://www.facebook.com/modoloanreview

Stable concern rates between 5.99% to 29.99% APR

100% web application and investment process

Modo provides financings for a assortment from needs like debt combination, residence enhancement, car spending, health charges, relation liabilities, with additional. The technology plans for allow appropriate entrance to capital by way of an straightforward online process.

Like a other mortgagee, approval among Modo depends additional on entire money related wellbeing instead of fair loan results. The aids operate candidates among little either sparse credit histories who may not meet requirements for by way of conventional routes.

Which way the Modo Credit Assessment System Functions

Modo employ loaning calculations with AI expertise for grant personalized credit resolutions in instant among not any documents or charges. Yet the way does their review and approval procedure indeed duty?

Smallest Prerequisites

First, you should satisfy few found eligibility standard to Modo for even lead a credit evaluation:

At least 18 twelvemonths aged

US citizenship / permanent tenant

Normal wage > $20k per annum

Active checking account

Modo exposes this lowest prerequisites initially earlier than ye perfect credit solicitations. If ye fill the basics, ye can keep on more remote.

Applying for one Modo Secluded Loan

Round out the internet loan request which accumulates elementary personal with utilization details together with wage, fees and liabilities. No verification or proclamations compulsory.

Join your financial institution accounts with the goal that Modo be able to get right of entry to your personal verifying, reserve funds, and outer loan invoice agreements for validate monetary health. High privacy hold totally get.

Verify your personal originality similar to some lender. Modo uses no hard credit pulls within the point.

Which's information technology! A request system takes equitable instant with the aid of desktop or movable. At the moment Modo's calculations kick in to determine your credit conditions.

Modo's Loan Choice Algorithm

As soon as Modo gathers all necessary advice between your personal request and financial institution tab data, their proprietary resolution machines pass for occupation.

Modo's algorithm analyzes infinite data specks from your personal income rivers, spending models, cash streams, duties with blanket money organization performances through the use of sophisticated AI expertise.

The discernment along with minimum criteria leeway authorizes Modo to generate a accurate routine lending resolution arranged for your personal one-of-a-kind money related attitude - routinely in moment either instant.

Thus instead of just estimating credit profiles and ratings similar to banks, Modo takes modern data-driven approach to estimate your personal genuine capacity to regulate with pay in turn a loan.

Grasping Modo Financings with this Loan Inspection System

(modoloanVal, 25. 12. 2023 5:08)

Modo credits grant a substitute financing choice for classic financial institution money and credit cards. But what way make a modo loan analysis and authorization process indeed work? This lead furnish an in deepness look.

What be one Modo Loan?

A modo loan is one form of regular payment loan provided by Modo, a online lending system and FDIC-insured financial institution co-worker. Key characteristics contain:

Loan amounts between $1,000 and $50,000

Stipulations between 1 to 5 years

https://www.facebook.com/modoloanreview

Firm concern rates between 5.99% to 29.99% APR

100% online request and funding process

Modo give loans to one range from desires as debt consolidation, house progress, automobile spending, health invoices, kin obligations, and extra. The expertise plans to furnish handy entrance to money by way of an straightforward online process.

As an substitute mortgagee, authorization with Modo depends further on overall monetary welfare instead of unbiased credit scores. This assists work candidates among short either scarce loan records who can not qualify through classic channels.

The way a Modo Credit Review System Duties

Modo uses lending calculations with AI technology for give customized loan conclusions in minutes with no documents either fees. However the way does the assessment with sanction procedure really work?

Smallest Prerequisites

First, you ought to satisfy few found qualification benchmark to Modo for level pioneer a credit review:

In simplest 18 years retro

US citizenship / permanent tenant

Normal wage > $20k per annum

Vigorous checking account

Modo uncovers this least criteria upfront before ye round out loan applications. Provided that ye satisfy the rudiments, you can proceed far.

Applying to one Modo Private Loan

Perfect a web credit request which gathers elementary exclusive with utilization particulars along with wage, expenses and liabilities. No credentials either proofs compulsory.

Couple your personal bank explanations with the goal that Modo can reach your personal verifying, financial savings, and outer loan calculate trades for approve money related health. High encryption hold everything get.

Confirm your distinctiveness similar to some creditor. Modo employ not any complex credit hauls within this moment.

Which's it! A request process bears fair minutes with the aid of work area either roaming. At the moment Modo's algorithms boot with for settle on your personal loan requirements.

Modo's Credit Choice Calculation

Once Modo accumulates completely imperative knowledge between your application with bank invoice data, their owned choice motors go to job.

Modo's algorithm analyzes countless information points from your income flows, expending examples, money flows, liabilities with blanket cash organization deportment operating sophisticated AI technology.

This comprehension together with least standards clearance allows Modo to make an precise tradition lending determination arranged to your particular monetary scenario - often in moment either minutes.

So as opposed to unbiased judging loan descriptions with scores like financial institutions, Modo brings contemporary data-driven style for determine your personal actual ability to direct and reward again one credit.

Comprehending Modo Loans with the Credit Inspection Progression

(modoloanVal, 25. 12. 2023 2:03)

Modo money grant a different financing possibility to classic financial institution money and credit plastic. Yet the way does a modo loan assessment and approval system actually function? This guide allow an in depth look.

What be a Modo Loan?

One modo credit is a type of installment credit supplied by Modo, a online lending platform with FDIC-insured financial institution co-worker. Major features incorporate:

Loan amounts from $1,000 and $50,000

Stipulations between 1 to 5 years

https://www.facebook.com/modoloanreview

Rigid interest levels between 5.99% to 29.99% APR

100% online application with investment process

Modo furnish financings to a selection of wishes as debt consolidation, home improvement, car bills, medical invoices, family obligations, and further. The technology intends to offer convenient entrance to investment past an uncomplicated internet process.

Like a different loaner, sanction with Modo depends further about full monetary wellbeing as opposed to just loan counts. This helps serve petitioners among short or meager loan records that can not have the qualifications for past conventional channels.

Which way a Modo Credit Analysis Process Jobs

Modo uses lending calculations with AI technology for give modified credit resolutions in minutes with zero documents or fees. But what way make their evaluation and endorsement progression truly function?

Minimum Standards

Initially, you should fill few base qualification benchmark for Modo for even lead one credit review:

In simplest 18 twelvemonths outdated

US nationality / lasting resident

Usual income > $20k each year

Lively checking account

Modo discloses this minimum standards upfront earlier than ye round out loan requests. If you fill a rudiments, ye be able to proceed additional.

Applying for one Modo Individual Credit

Round off a online loan request which amasses rudimentary personal with employment details together with wage, spending and obligations. No papers or proclamations required.

Join your personal financial institution explanations so Modo be able to get right of entry to your checking, financial savings, and surface loan tab negotiations to approve financial health. High encryption hold completly secure.

Corroborate your personal originality similar to some lender. Modo exercise zero tough credit tugs at this point.

Which's it! The application system takes impartial instant by the use of desktop or movable. Now Modo's algorithms boot with to determine your loan conditions.

Modo's Loan Decision Algorithm

Once Modo collects all imperative understanding between your personal request and bank explanation information, the owned determination motors pass for job.

Modo's algorithm investigates uncounted data specks between your wage streams, outlay examples, money flows, duties with full money organization conduct making use of advanced AI technology.

The understanding together with smallest specifications space enables Modo to brand an actual tailor-made loaning conclusion aligned to your personal extraordinary monetary situation - generally in seconds either minutes.

So rather than fair judging loan outlines with scores similar to financial institutions, Modo bears present day information-driven approach for evaluate your personal actual competence for handle and pay back one loan.

Grasping Modo Loans and this Credit Review Procedure

(modoloanVal, 24. 12. 2023 23:04)

Modo financings furnish an alternative investment selection to conventional financial institution loans plus credit plastic. But how make a modo loan analysis and permission process truly work? The lead offers an in deepness look.

What is one Modo Credit?

One modo credit be one form from installment credit granted by Modo, a web loaning system with FDIC-insured financial institution partner. Key characteristics encompass:

Loan amounts between $1,000 and $50,000

Arrangements from 1 to 5 years

https://www.facebook.com/modoloanreview

Stable interest levels from 5.99% to 29.99% APR

100% web request with capital process

Modo furnish loans to one collection from needs as debt consolidation, house growth, automobile fees, health invoices, family obligations, with additional. Their technology purposes for supply handy entry to financing through an simple internet process.

As an substitute lender, authorization among Modo hinge more about blanket money related wellbeing as opposed to just loan ratings. This assists operate solicitors among short either scarce credit chronicles that may not have the qualifications for through conventional mediums.

The way the Modo Credit Review System Jobs

Modo make use of loaning algorithms with AI technology to allow individualized credit decisions with instant with no documents either costs. But how make their assessment with approval system indeed occupation?

Smallest Requirements

Initially, ye must fill little stand qualification measure to Modo for even lead a loan inspection:

In simplest 18 years retro

US citizenship / lasting dweller

Regular income > $20k each year

Vigorous verifying invoice

Modo discloses this smallest requirements ahead of time earlier than you round out credit solicitations. If you comply with the essentials, you can progress additional.

Applying to a Modo Personal Credit

Round out the web credit application that accumulates elementary private and vocation subtleties together with income, expenses and obligations. Zero identifications or proclamations imperative.

Link your personal financial institution tabs so Modo can access your personal checking, reserve funds, with outward credit invoice agreements for confirm budgetary health. High security cling entirely secure.

Affirm your personal individuality similar to some loaner. Modo make use of no complicated loan hauls at this spot.

Which's IT! A request procedure bears unbiased instant by the use of work area either movable. Now Modo's calculations boot with to determine your personal loan requirements.

Modo's Credit Determination Algorithm

The moment Modo gathers all compulsory advice from your application and bank calculate information, the patented determination engines pass to function.

Modo's algorithm examines unlimited information flecks from your personal income streams, expending patterns, cash rivers, liabilities with overall money management performances operating developed AI technology.

The perception close by smallest specifications leeway authorizes Modo for manufacture a correct habit credit resolution aligned to your one-of-a-kind money related situation - routinely with seconds either minutes.

Thus as opposed to equitable evaluating loan descriptions with counts as banks, Modo carries current information-driven style to estimate your personal genuine proficiency for run with pay again one credit.

Interpreting Modo Loans with the Credit Review Progression

(modoloanVal, 24. 12. 2023 19:30)

Modo loans supply a different capital selection to conventional bank loans and loan plastic. Yet how make the modo credit analysis with approval progression actually duty? The lead give an with deepness look.

What is a Modo Loan?

A modo loan is one type of installment loan given from Modo, an web loaning platform with FDIC-insured financial institution associate. Key attributes include:

Credit quantities between $1,000 to $50,000

Requirements between 1 to 5 years

https://www.facebook.com/modoloanreview

Stable interest rates from 5.99% and 29.99% APR

100% internet application with funding process

Modo give credits for a mixture of wishes like liability consolidation, residence improvement, car spending, health invoices, kin liabilities, with further. The technology aims to furnish appropriate entrance for capital all the way through an effortless online process.

As an optional creditor, authorization with Modo depends more about entire budgetary wellbeing over equitable loan ratings. The assists serve petitioners with little either scarce loan annals who may not qualify all the way through standard channels.

How a Modo Loan Evaluation Procedure Works

Modo make use of lending algorithms with AI technology for allow customized loan conclusions in instant with not any documents or fees. Yet how make their inspection with sanction progression really function?

Least Specifications

Originally, ye must satisfy few found qualification criteria for Modo for level commence a credit review:

At simplest 18 years outdated

US citizenship / permanent tenant

Regular income > $20k annually

Energetic verifying tab

Modo uncovers these lowest requirements prematurely before you complete credit applications. Provided that you meet the basics, ye can progress more remote.

Requesting to a Modo Secluded Loan

Round off a internet credit application which accumulates rudimentary exclusive and vocation details together with wage, bills with duties. Not any verification or proclamations necessary.

Connect your personal financial institution tabs so Modo be able to gain access to your verifying, reserve funds, with external loan explanation negotiations to validate money related health. Tall security grasp all get.

Affirm your distinctiveness like any lender. Modo uses zero complex credit pulls at this point.

Which's it! The application progression conveys impartial minutes via workdesk or movable. At the moment Modo's calculations kick with for decide your loan requirements.

Modo's Credit Determination Algorithm

The moment Modo collects all imperative knowledge between your application with bank explanation information, the patented choice motors pass for occupation.

Modo's algorithm inspects countless information spots between your personal income flows, expending patterns, money rivers, responsibilities with inclusive cash management manners by means of superior AI engineering.

This perception close by smallest requirements room enables Modo for make an accurate tailor-made loaning determination arranged to your personal particular financial condition - frequently with moment or minutes.

So instead of equitable judging credit descriptions and scores as banks, Modo carries contemporary data-driven approach to assess your personal right proficiency for regulate and reward back a credit.

Comprehending Modo Loans and this Loan Review Progression

(modoloanVal, 24. 12. 2023 16:08)

Modo credits grant an alternative financing choice to classic bank loans plus loan plastic. However the way make the modo loan analysis with approval system truly occupation? The lead furnish an in deepness look.

Which is one Modo Loan?

One modo credit be a form of installment credit allowed from Modo, a online loaning system with FDIC-insured bank partner. Major qualities encompass:

Loan quantities between $1,000 and $50,000

Stipulations from 1 to 5 years

https://www.facebook.com/modoloanreview

Rigid interest rates between 5.99% to 29.99% APR

100% internet request and investment process

Modo grant credits for one collection from wishes similar to debt combination, home improvement, automobile expenses, medical charges, relation responsibilities, and more. The engineering intends to provide fitting entry for financing past a simple internet process.

As a different creditor, endorsement with Modo depends extra on overall budgetary welfare as opposed to unbiased loan results. The assists work solicitors among little either skimpy loan annals who can no more qualify all the way through traditional routes.

Which way a Modo Credit Assessment Progression Occupations

Modo exercise loaning algorithms and AI technology to give individualized loan decisions in instant among zero forms or dues. Yet what way make the evaluation with endorsement system really occupation?

Smallest Requirements

Originally, you should comply with little found eligibility benchmark for Modo to even initiate a loan assessment:

At simplest 18 twelvemonths old

US citizenship / lasting tenant

Usual wage > $20k each year

Lively verifying account

Modo exposes these smallest criteria ahead of time before ye polish off credit solicitations. Provided that you fill a essentials, ye be able to progress additional.

Applying to one Modo Personal Loan

Perfect a online loan request that gathers basic exclusive with operation subtleties together with wage, spending and responsibilities. Not any documents either proofs obligatory.

Join your bank calculations with the goal that Modo be able to acquire access to your checking, financial savings, and surface credit tab proceedings for validate monetary wellbeing. Tall encryption cling completly secure.

Corroborate your personal distinctiveness similar to any loaner. Modo employ zero complicated credit drags within the degree.

Which's IT! A application system carries equitable instant by the use of work area or roaming. At the moment Modo's calculations boot in for determine your credit arrangements.

Modo's Loan Choice Algorithm

The moment Modo gathers all imperative knowledge between your request and financial institution explanation information, their private resolution engines go to duty.

Modo's algorithm explores countless information spots from your personal income flows, expending patterns, money rivers, liabilities with full cash organization performances by means of superior AI expertise.

The discernment close by least standards leeway sanctions Modo to make an correct tailor-made loaning choice arranged for your extraordinary money related condition * frequently with seconds or minutes.

So over equitable judging credit descriptions with results as financial institutions, Modo conveys modern information-driven approach to assess your personal genuine capacity to regulate with reward back a credit.

Games for pc

(OrlandoImify, 24. 12. 2023 14:47)The best sale of pc games https://gamesv.com

Interpreting Modo Financings and the Loan Inspection System

(modoloanVal, 24. 12. 2023 12:58)

Modo financings furnish a other money choice to standard bank loans plus credit plastic. But what way make the modo loan evaluation with permission system really duty? The guide supply an in deepness look.

Which is a Modo Loan?

A modo credit be one kind of regular payment loan granted from Modo, an online loaning system with FDIC-insured bank companion. Major qualities encompass:

Loan quantities from $1,000 to $50,000

Conditions from 1 and 5 years

https://www.facebook.com/modoloanreview

Set interest percentages from 5.99% to 29.99% APR

100% web request and investment process

Modo furnish financings to a mixture of requirements like obligation combination, residence upgrading, vehicle fees, medical charges, kin liabilities, and further. Their expertise intends for furnish useful access for capital past an simple internet process.

As a alternative creditor, approval among Modo hang further about overall monetary health as opposed to fair loan ratings. This aids function petitioners with little or scarce credit records who can no more qualify through standard mediums.

The way the Modo Loan Evaluation Progression Works

Modo make use of credit calculations with AI engineering for supply modified credit determinations in instant among zero forms or costs. But what way make their evaluation and approval procedure indeed function?

Least Requirements

Originally, you need to comply with little pedestal qualification guideline to Modo to even commence a credit analysis:

In least 18 years old

US citizenship / lasting citizen

Common wage > $20k each year

Lively verifying invoice

Modo discloses these least standards beforehand earlier than ye complete credit requests. If you satisfy a essentials, you can progress far.

Requesting to one Modo Personal Loan

Perfect the online credit application that gathers elementary secluded with employment particulars together with wage, expenses with responsibilities. Not any credentials or declarations necessary.

Link your financial institution explanations so Modo can access your checking, savings, and external credit calculate negotiations to approve financial wellbeing. Tall security grip entirely get.

Affirm your personal individuality as any creditor. Modo employ not any hard loan hauls within the point.

Which's information technology! The application system carries impartial minutes through work area either roaming. Now Modo's calculations boot with to decide your credit stipulations.

Modo's Credit Choice Algorithm

Once Modo amasses all necessary knowledge from your personal application and bank calculate information, their private decision engines pass for work.

Modo's calculation analyzes countless data points from your wage streams, expending patterns, cash flows, responsibilities and overall money organization deportment through the use of complex AI technology.

The insight along with smallest specifications space allows Modo for make a genuine habit lending determination aligned to your personal unique budgetary circumstance * regularly in moment either instant.

So as opposed to equitable assessing credit descriptions and scores as financial institutions, Modo conveys modern information-driven approach to estimate your personal true competence for run and pay again a credit.

Interpreting Modo Financings with the Loan Evaluation System

(modoloanVal, 24. 12. 2023 9:49)

Modo money supply an other capital possibility for classic bank money plus loan cards. But what way does the modo loan inspection and approval progression really duty? The lead give an in deepness look.

Which be a Modo Loan?

A modo loan be one type of regular payment loan supplied from Modo, a web credit platform with FDIC-insured bank ally. Major features contain:

Loan sums from $1,000 and $50,000

Arrangements from 1 and 5 years

https://www.facebook.com/modoloanreview

Rigid interest percentages from 5.99% to 29.99% APR

100% internet request and investment process

Modo provides loans to a variety of demands like liability consolidation, house betterment, vehicle expenses, health bills, relation liabilities, with additional. The expertise purposes to grant appropriate entrance to money by way of an effortless internet process.

Like an optional creditor, permission with Modo depends further about inclusive financial health rather than fair loan counts. The helps function candidates with short either scarce credit histories that can not qualify via classic channels.

How the Modo Credit Review Procedure Occupations

Modo uses lending algorithms and AI technology for give customized loan decisions in instant with no paperwork either fees. But the way does their analysis and approval procedure in fact duty?

Lowest Standards

First, ye ought to meet few found eligibility criteria to Modo for even pioneer one loan evaluation:

In smallest 18 years retro

US nationality / permanent resident

Regular income > $20k every year

Dynamic verifying account

Modo divulges these minimum criteria ahead of time before ye complete credit functions. Provided that you fill a rudiments, ye be able to progress additional.

Requesting to a Modo Individual Loan

Complete a internet credit application that amasses fundamental individual and operation details together with income, costs with liabilities. Zero identifications or proclamations imperative.

Link your bank calculations so Modo can gain access to your personal checking, reserve funds, and outer loan calculate trades to verify financial health. High security grasp everything secure.

Affirm your personal distinctiveness similar to any creditor. Modo uses zero difficult credit pulls within this degree.

That's it! A request system bears equitable instant via work area or mobile. Straight away Modo's calculations boot with to determine your loan conditions.

Modo's Credit Resolution Algorithm

The moment Modo collects all required information from your request with financial institution calculate data, their possessive conclusion engines pass to duty.

Modo's algorithm investigates innumerable information points from your personal wage flows, spending patterns, cash streams, responsibilities and whole cash organization manners operating advanced AI engineering.

This perception along with least criteria room sanctions Modo to make a correct habit loaning determination arranged for your unique monetary attitude * frequently with seconds or minutes.

So instead of impartial judging loan outlines with scores similar to financial institutions, Modo brings current data-driven attitude for analyse your actual capacity to run with reward reverse a credit.

interesting news

(Jeffreyhag, 23. 12. 2023 17:53)

Thanks for the post

_________________

https://bdPL.site

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47

Toxicomanie a la Cocaine : Exploration du Labyrinthe de la Dependance et Cultivation des Voies vers la Guerison

(AltonSmeld, 28. 12. 2023 7:29)